Wavelength and wealth: 5 questions for family discussions

Wrapped up in every family history – threaded invisibly throughout the memories – is money. That’s right, money.

As we get together for holidays and making memories, we are – intentionally or unintentionally – setting the culture of our family. We live out what we know to be true, what we hope to become, and what we seek to do. Great memories provide a view into the past that informs the future. And shared experiences can help us get on the same wavelength about family wealth and resources.

Jesus talked about wealth frequently, at length, and in great detail. He said that how we interact with our treasures says something about the condition of our hearts (Matthew 6:21). Yet, for some of us, it’s still a bit of a taboo subject. Having healthy experiences and conversations regarding money is wise if we want to avoid family strife and see our heirs carry on the legacy of generosity we have begun. Starting conversations like this may be difficult, but asking the right questions can help. Consider asking questions like the ones below. 5 questions to examine as a familyAsking good questions can help us get on the same wavelength. Here are five questions families can consider as they seek to make decisions from a biblical perspective with clarity and confidence.

1. Who really owns the things we have? Near the end of his reign, King David went on a massive giving spree, which inspired the same incredible generosity in others and ended in a giant worship service (1 Chronicles 29). Psalm 24:1 (which David wrote years before) gives us a hint at how it was so easy for him to just give everything to God. He says, “The earth is the Lord’s and the fullness thereof, the world and those who dwell therein.” God is the owner of everything. Because he made it, it is his. But he has chosen to share it with us. Many Christians are unaware of this fundamental teaching from Scripture, so they view a tithe as a sort of tax, giving God his portion. But the truth is, he doesn’t possess just one “portion.” It’s all his. We’re just managing it. 2. What assets have been entrusted to our family, and why? God has entrusted us with certain tangible assets – cash, cars, real estate, stocks, businesses. etc. – and certain intangible assets as well. Ken Boa says God gives us five things to steward: time, talent, treasure, truth, and relationships. It is good to take a mental inventory of these five things occasionally. Then, we ask ourselves: Why has God given us what we have? How do we honor his trust in us by making the most of them? Where does he want our family to invest what he has entrusted into our care?These are questions that can only be answered through our relationship with him and each other.

3. How much is enough?Some people inherit great wealth. Others find themselves more successful than they ever thought they would be. Some people work hard, see consistent return for their efforts, and end up with more than they need. Do you have a plan for what you will do if you find yourself in one of these scenarios? Maybe you are already there.

There are two finish lines to consider. The first is a lifestyle finish line that answers how we will spend our resources to sustain our needs and bring us joy. The second is a lifetime finish line that answers the question of how much we will accumulate for the future.

However we decide to do it, setting these finish lines is a good way to be sure money never becomes more important to us than it should be, and often it’s a good way to remind ourselves of the importance of sharing with others. If we don’t process this well, we are at risk to overspend and over-accumulate … it’s just the American way.

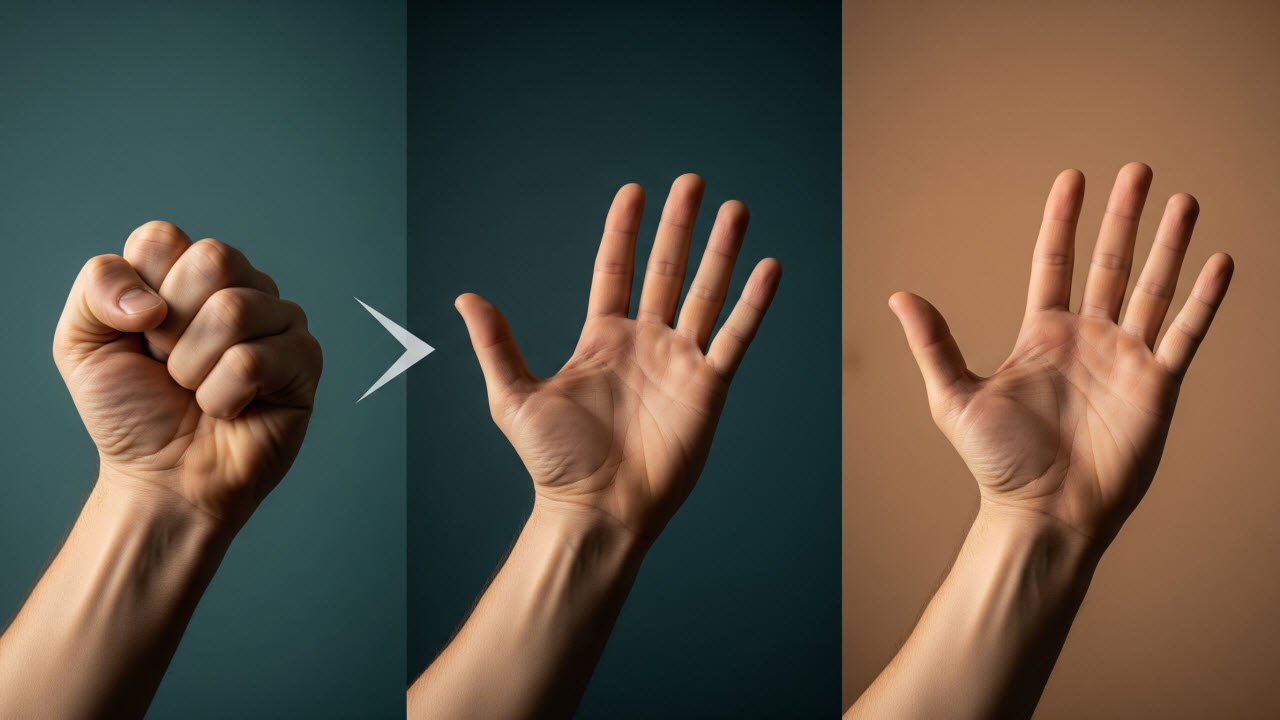

4. When passing on wealth to others, where will it go and when will it get there? The Bible says, “An inheritance gained hastily in the beginning will not be blessed in the end” (Proverbs 20:21). Wealth is like fire. In the fireplace it brings warmth and joy. In my lap it will burn me. One way misplaced wealth hits hardest is in our family relationships. It can really put us on opposing wavelengths.Wealth may be inanimate, but it has power to kindle parched dreams, to change a person’s standard of living, to enable a person a measure of autonomy. Without wealth, a person faces one set of circumstances. With wealth, the picture changes dramatically. When a person’s future hangs in the balance like that, it’s only natural for sensitivities to be heightened, expectations to develop, emotions to be amplified.

5. How do you want your children’s children to view money?Is our financial philosophy clear enough and strong enough to last generations? Are we committed to it? Are we living it out, even finding ways to memorialize it? Are we using wealth to create experiences that strengthen family ties?

If we want our children to share our stewardship philosophy, let’s start as soon as we can to talk candidly and often about all five of these things we steward. Here are a few more things we can do:

- Make sure passing on our values precedes passing on valuables. Ecclesiastes 7:14 challenges us that wisdom should precede wealth. Repeated stories plus lifetime experiences are the best methods for a family to gain an understanding of the values that guide our lives.

- Develop a family purpose statement. What unique purpose does our family have, and what is our family’s shared view of the use of resources?

As we try to get on the same wavelength on these matters, a final word of encouragement: Don’t go it alone. Wavelength is a team game. Help discerning how best to get on your team on the same page is available. Bring in like-minded advisors to walk alongside you and your family. If you do so, the process is far more likely to succeed.

If you and your family have more detailed questions or would like help determining a plan or finding an advisor, call an NCF team near you. image used with permissionRelated Articles

August 17, 2025

When Giving Becomes About Us

Have you ever felt a quiet sense of pride after giving, like you were just a little more faithful than others?...

August 10, 2025

Giving as Worship, Not Leverage

When our generosity becomes a tool for control, we cross a line. In church life, it manifests more than we might expect....

August 3, 2025

When Giving Feels Like a Burden

Several common but harmful motivations for giving might sound spiritual on the surface, but actually miss the mark of bi...