6 Things That Can Lead Loving Parents Into Debt

We want what is best for our kids, but this good desire leads us down the path of poor financial decision-making.

If you are a parent, you have been there before. The love for your children is deep. And out of the deep love we have for our children flows a desire for them to experience good things. We want what is best for our kids.

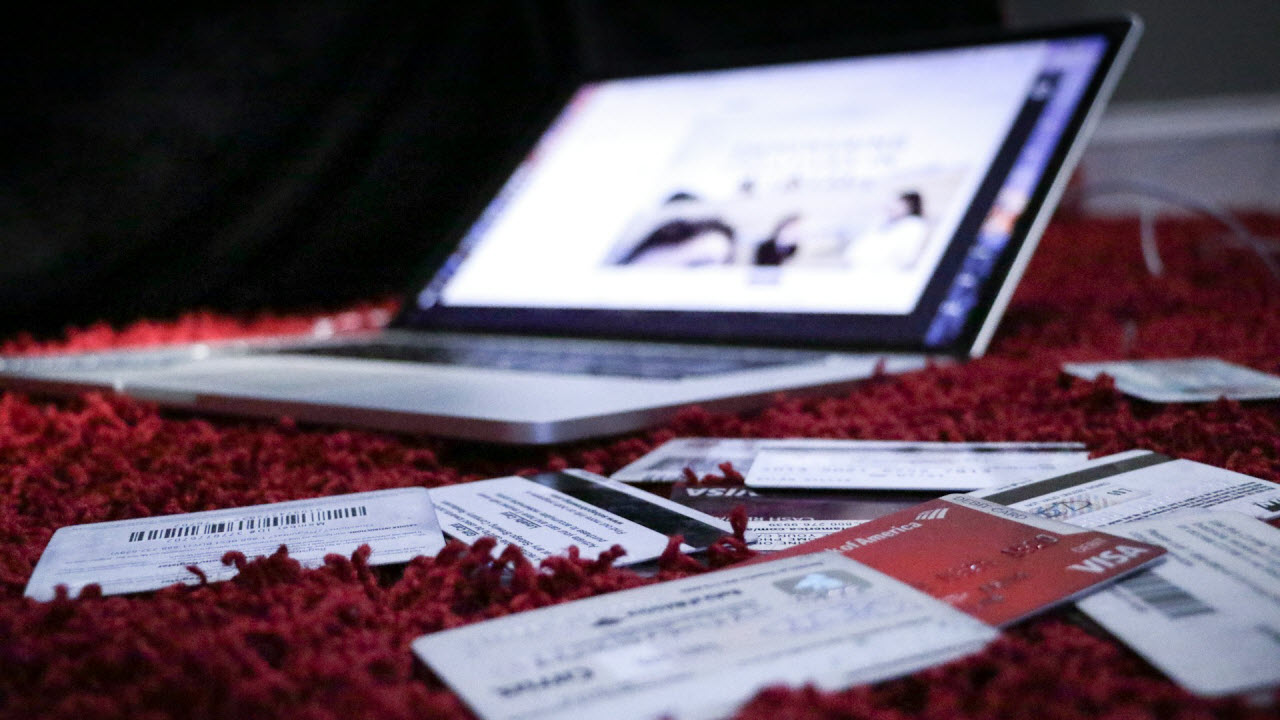

But sometimes this good desire leads us down the path of poor financial decision-making. We spend money that we don’t have on our children and find ourselves sinking in an ocean of debt.

We find ourselves asking, “How did we get here? How did we become a living proof that the personal debt statistics we hear are actually true?”

How do parents get there? Consider these five common causes:

1. Keeping up with the Joneses.You have probably heard this phrase before. “Keeping up with the Joneses” is simply trying to maintain the lifestyle of those around you. Your neighbor or coworker dresses their children in high-end children’s clothing so you want to do the same. Or your neighbor sends their children to private school, so you decide to follow suit, even though you really can’t afford the cost.

The Joneses are a frustrating crew to chase because they are always shifting the standard. As soon as you feel that you have arrived, they move it slightly out of reach again. So we need to be careful. There will always be other parents who spend more on their children. And who knows, they, like you, may be using debt to finance their expenditures. You could be chasing a façade.

2. Spending too much time on social media.Mentally, you know that the images you see on Facebook, Instagram, and Twitter are simply the filtered versions of those you follow. You know this because you do the same things, only posting what you want everyone else to see, the images that makes your life seem perfect.

But the constant barrage of great vacations (They are going to Disney again?), child accolades (Does their son ever make a B?), and perfect family moments (I hate that I love their smiles.), can make you feel like a bad parent. You can easily create unrealistic expectations, and try to buy your way to feeling better about yourself.

3. Thinking that your kids will not succeed in life if they don’t have it all.Extracurricular activities have entered a whole new realm. Travel leagues, academic and athletic camps, and private tutoring and athletic training have become commonplace. You want your child to succeed in life. And you are afraid that if you do not provide your child with these opportunities, they will fall behind. So you try to provide it all.

Unfortunately, there is a cost to all these activities and experiences. Not only do they leave little margin in you and your child’s schedule (including time at church), they eat up the margin in your budget. Are extracurriculars good? Absolutely. But are they worth going into debt? Absolutely not.

4. Caring more about our child’s future career than their future character.

4. Caring more about our child’s future career than their future character.

This could certainly be a subpoint of the above point. Often, the focus of our parenting is centered on getting our child into a good school or setting them up to have good career. While school and career are not unimportant, they are not the most important. The most important part of parenting, shepherding our children’s hearts, is difficult and time-consuming. But it is also less costly.

5. Wanting to give them what you did not have growing up.You can probably remember a time when, as a child, you did not get something you wanted. Maybe it was a new bike. Maybe, as a teenager, it was a certain car. You or your parents could not afford it. And you remember how you felt.

Now that you are a parent, you want to ensure that your child doesn’t experience those same feelings. You don’t want them to feel lacking. So when they ask, they get. Even if the purchase requires the swipe of a credit card.

6. Not considering how lacking helped you as a kid.You remember what it feet like a child who wanted something but could not get it. But do you also remember what resulted from not being able to get that item? You may have resorted to more creative play. If you were a teenager, you may have resorted to getting a job. These moments in your childhood assisted you in your growth as a individual.

Now consider who you may be now if everything you wanted, you received. For most of us, it’s a scary thought. Lacking was not necessarily bad for you. In fact, lacking may have resulted in more good than bad for you. And it is the same for your child. It is okay for your child not to have everything they want. It may be best. And it is okay to say “no” when a purchase hurts the budget.

Your financial health matters to your children. This is especially true in the future, when your children turn into adults. Frequently, the consequence of poor financial decision-making of parents ends up falling on the shoulders of their adult children. Worry about your financial health now so that your children do not have to worry about your financial health in the future.

Love your children well. Teach them to love God, not stuff. Teach them to give, not get. Teach them that financial resources are meant to advance God’s Kingdom, not their own. *Image used with permission. *Related Articles

May 21, 2025

The Danger of Buy Now, Pay Later

May 18, 2025

The Hidden Danger of Buy Now, Pay Later

In a culture of instant gratification, it's easier than ever to get what we want, even if we can't afford it....

March 2, 2025

What is good debt vs. bad debt?

Is all debt bad? Or does some good debt exist? Here are the biblical principles to discern the difference....