Uncle Sam's Borrowing Binge

Congress suspended the federal debt ceiling in early June, passing a bill titled The Fiscal Responsibility Act of 2023.

Since then, the run-up in federal spending and debt has been breathtaking. In less than four months, U.S. government debt has grown by almost $1,000,000,000,000 ($1 trillion).

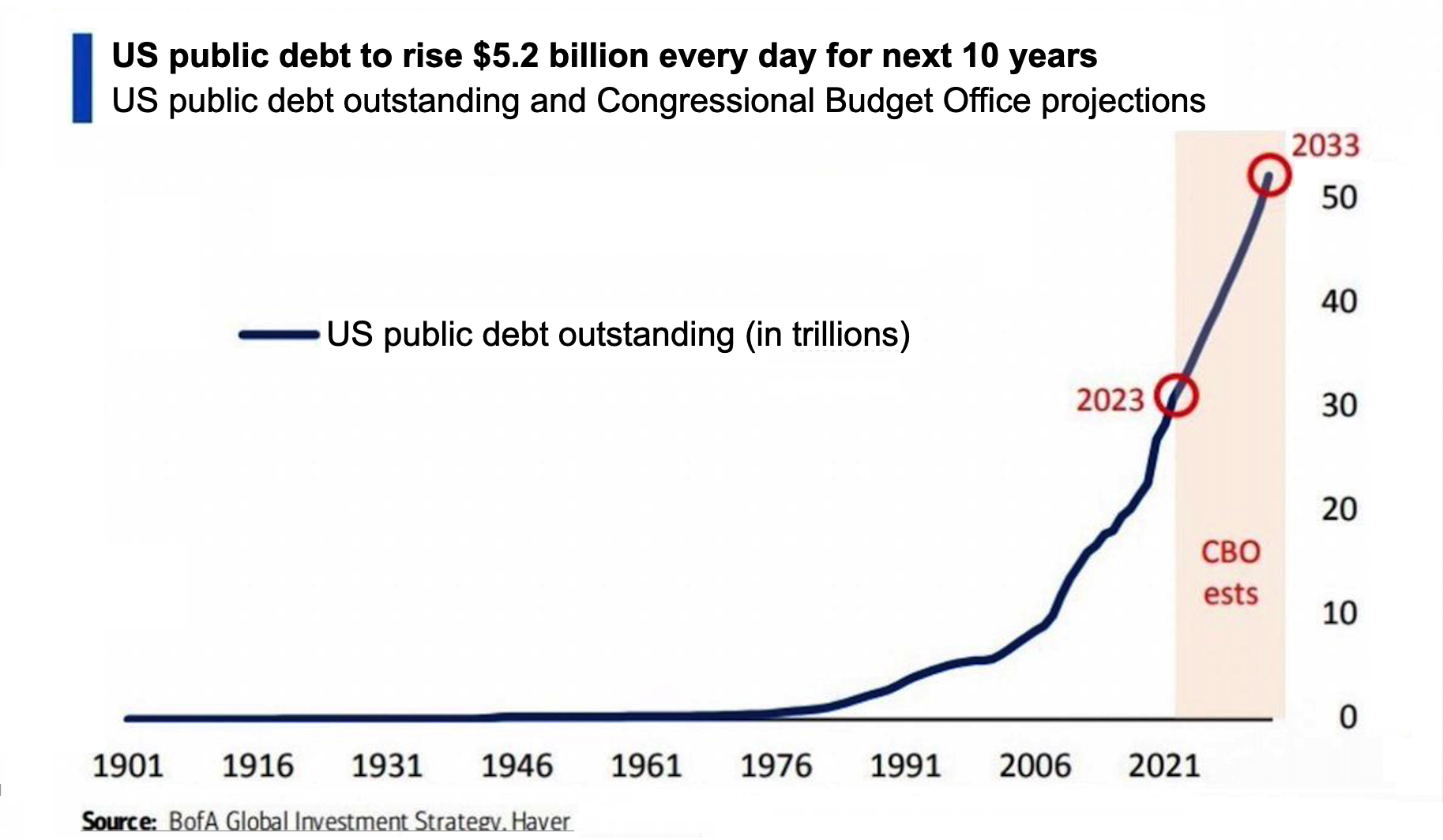

The Congressional Budget Office (the budgeting arm of Congress) projects that the U.S. debt will grow $5.2 billion per day for the next decade. And, as this chart shows, that will bring us to a debt of $50 trillion by 2033 — an increase of roughly $17 trillion over just 10 years. (The amount would have been even higher without the modest spending restraints in The Fiscal Responsibility Act.)

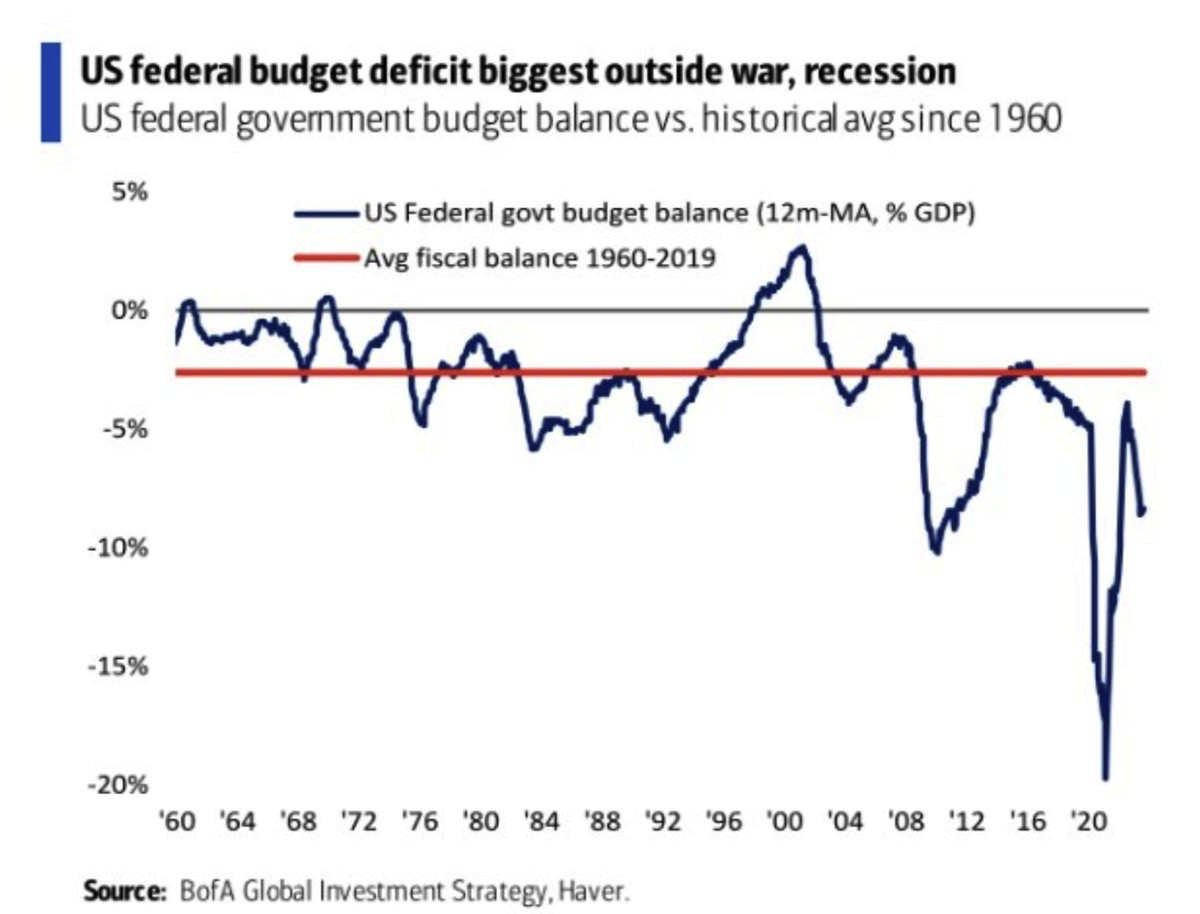

Of course, Washington has routinely outspent its tax revenues (with only a slight swing in the other direction in the 1990s). The difference now is a sharp downturn toward the level of deficits that historically occurred only in times of war or recession.

This chart shows the deepening deficits related to the recession in 2008-2009 and the COVID era. Now, after a brief post-COVID improvement, deficits are expanding again.

The two charts above suggest that government overspending is at the threshold of becoming unmanageable. In the past, economic growth typically generated enough tax revenue to keep deficits manageable. Today, tax revenues aren't keeping up, and debt sales (T-Bills, T-Bonds, T-Notes, Savings Bonds, etc.) must fill the ever-increasing gap.

Interest alone now costs nearly $3,000,000,000 ($3 billion) per day as the government issues debt that must pay higher and higher interest rates.

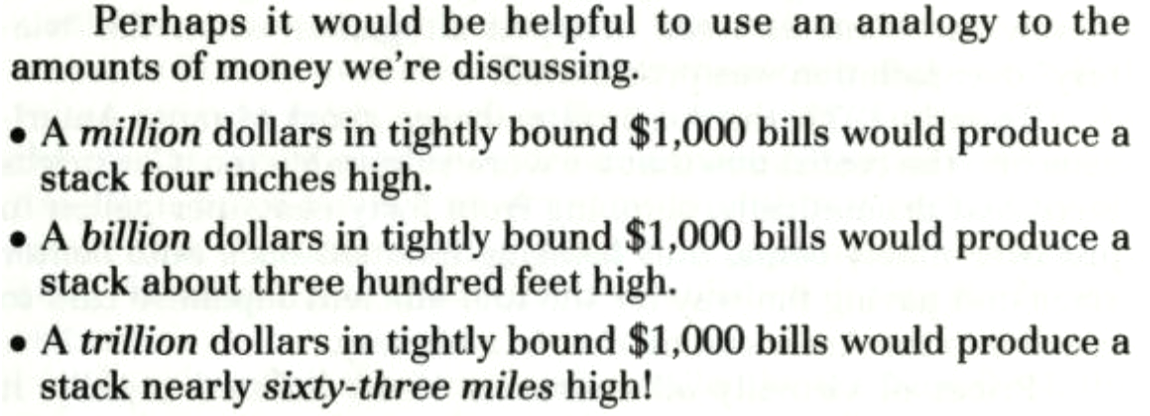

So what? The amount of money the U.S. government spends and borrows is so large that the numbers are difficult to comprehend. Here's a helpful "visual" example from Larry Burkett's 1994 book, The Coming Economic Earthquake.

OK, we've added "63 miles of debt" in the past four months. So what? It sounds terrible, but is it a problem? And is the fact that we are heading toward a $50 trillion national debt a genuine cause for concern?

Some people (including many government leaders) argue that the rapidly growing debt is not an issue because 1) the U.S. government remains the best credit risk in the world, and 2) as long as Uncle Sam can service his debt, the size of the debt doesn't matter.

Let's call that what it is: a theory. Maybe it's a good theory, but maybe not. One thing is for sure: Like many other theories currently in vogue — related to everything from public safety to public morals — "the debt doesn't matter" theory has high stakes. If the theorists are wrong, there's trouble ahead.(For those who argue that the size of the national debt doesn't matter, I have a question: If the debt level is unimportant, why have taxes? Why not borrow for everything?)

"If something can't go on forever..." Years ago, I had the privilege of assisting Larry Burkett with research for The Coming Economic Earthquake. Some criticized the book as simplistic regarding the U.S./world economy.Larry acknowledged (in the book itself) that his argument was simplified, given that it was written for a non-technical audience. But he stressed that his premise was consistent with basic economics and historical experience: debt — personal, business-related, or governmental — cannot expand indefinitely. At some point, a time of reckoning must occur. (Most of us can recall that many individuals and businesses endured a wrenching debt reckoning during the Global Financial Crisis of 2007-2009.)

Larry argued that while governments can "kick the can down the road" longer and more effectively than businesses or individuals, "can kicking" typically leads to higher taxes, the crowding out of private investment, and inflation. And ultimately, a larger reckoning will likely unfold.

Economist Herb Stein made this simple yet profound observation: "If [something] can't go on forever, it will stop." Of course, we never know when it will stop or how it will stop! But I suspect that Uncle Sam's borrowing binge will lead to some rough sledding ahead. What do you think? Images used with permissionRelated Articles

May 21, 2025

The Danger of Buy Now, Pay Later

May 18, 2025

The Hidden Danger of Buy Now, Pay Later

In a culture of instant gratification, it's easier than ever to get what we want, even if we can't afford it....

March 2, 2025

What is good debt vs. bad debt?

Is all debt bad? Or does some good debt exist? Here are the biblical principles to discern the difference....